Stockcalc Fundamental Valuation Indicator

This NinjaTrader® add-on shows fundamental valuation for the company you are examining. At Stockcalc we value 8000 companies each night using 6 valuation models or data points and determine a Weighted Average Valuation from these calculations for display. This add-on is included in a Stockcalc subscription (emailed upon registration).

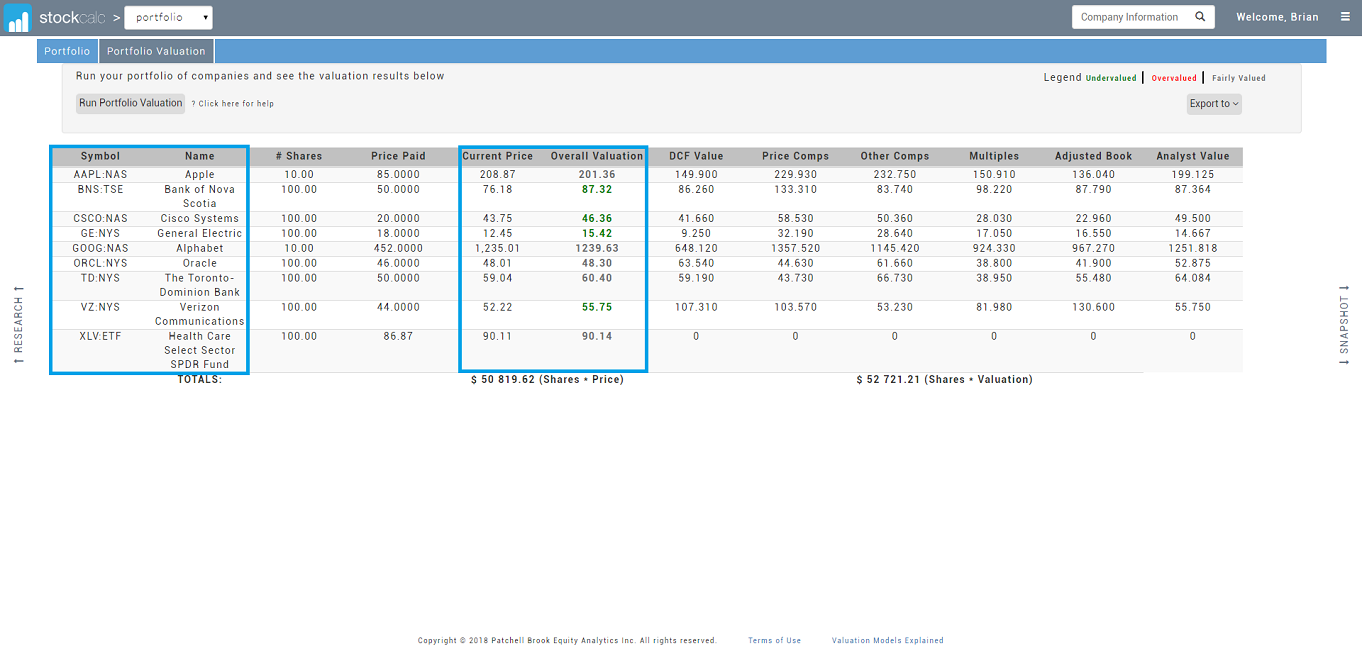

click to enlarge

click to enlarge

Valuation Models: Discounted Cash Flow (DCF) valuation is a cash flow model where cash flow projections are discounted back to the present to calculate value per share. Price Comparables: values the company we are looking at on the basis of ratios from selected comparable companies using PE, PB, PS, PCF and EV to EBITDA. Other Comparables: We have included the Other Comparables as a way to value companies that cannot be valued using Earnings based ratios. Multiples: Multiples are similar to Price comparables for the company against itself. Adjusted Book Value (ABV):We multiply book value per share by its historical PB ratio to calculate value per share. Analyst Consensus: If we have Analyst coverage for the company we use consensus target price.